RSS Feed

https://www.simplifyingthemarket.com/?a=269903-a3bc7e0ef3552315f90c02ba2f4aea1e

The way Americans work has changed in recent years, and remote work is at the forefront of this shift.

The way Americans work has changed in recent years, and remote work is at the forefront of this shift. Experts say it'll continue to be popular for years to come and project that 36.2 million Americans will be working remotely by 2025. To give you some perspective, that's a 417% increase compared to the pre-pandemic years when there were just 7 million remote workers.

If you're in the market to buy a home and you work remotely either full or part-time, this trend is a game-changer. It can help you overcome some of today's affordability and housing inventory challenges.

How Remote Work Helps with Affordability

Remote or hybrid work allows you to change how you approach your home search. Since you're no longer commuting every day, you may not feel it's as essential to live near your office. If you're willing to move a bit further out in the suburbs instead of the city, you could open up your pool of affordable options. In a recent study, Fannie Mae explains:

Home affordability may also be a reason why we saw an increase in remote workers willingness to relocate or live farther away from their workplace . . .

If you're thinking about moving, having this kind of location flexibility can boost your chances of finding a home that fits your budget. Work with your agent to cast a wider net that includes additional areas with a lower cost of living.

More Work Flexibility Means More Home Options

And as you broaden your search to include more affordable options, you may also find you have the chance to get more features for your money too. Given the low supply of homes for sale, finding a home that fits all your wants and needs can be challenging.

By opening up your search, you'll give yourself a bigger pool of options to choose from, and that makes it easier to find a home that truly fits your lifestyle. This could include homes with more square footage, diverse home styles, and a wider range of neighborhood amenities that were previously out of reach.

Historically, living close to work was a sought-after perk, often coming with a hefty price tag. But now, the dynamics have changed. If you work from home, you have the freedom to choose where you want to live without the burden of long daily commutes. This shift allows you to focus more on finding a home that is affordable and delivers on your dream home features.

Bottom Line

Remote work goes beyond job flexibility. It's a chance to broaden your horizons in your home search. Without being bound to a fixed location, you have the freedom to explore all your options. Reach out to a local real estate agent to find out how this freedom can lead you to your ideal home.

For Buyers First Time Home Buyers Buying Myths Wed, 20 Sep 2023 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2023/09/19/your-home-equity-can-offset-affordability-challenges?a=269903-a3bc7e0ef3552315f90c02ba2f4aea1e

Are you thinking about selling your house?

Are you thinking about selling your house? If so, today's mortgage rates may be making you wonder if that's the right decision. Some homeowners are reluctant to sell and take on a higher mortgage rate on their next home. If you're worried about this too, know that even though rates are high right now, so is home equity. Here's what you need to know.

Bankrate explains exactly what equity is and how it grows:

"Home equity is the portion of your home that you've paid off and own outright. It's the difference between what the home is worth and how much is still owed on your mortgage. As your home's value increases over the long term and you pay down the principal on the mortgage, your equity stake grows."

In other words, equity is how much your home is worth now, minus what you still owe on your home loan.

How Much Equity Do Homeowners Have Now?

Recently, your equity has been growing faster than you might think. To help contextualize just how much the average homeowner has, CoreLogic says:

". . . the average U.S. homeowner now has about $290,000 in equity."

That's because, over the past few years, home prices went up significantly and those rising prices helped your equity to accumulate faster than usual. While the market has started to normalize, there are still more people wanting to buy homes than there are homes available for sale. This high demand is causing home prices to go up again.

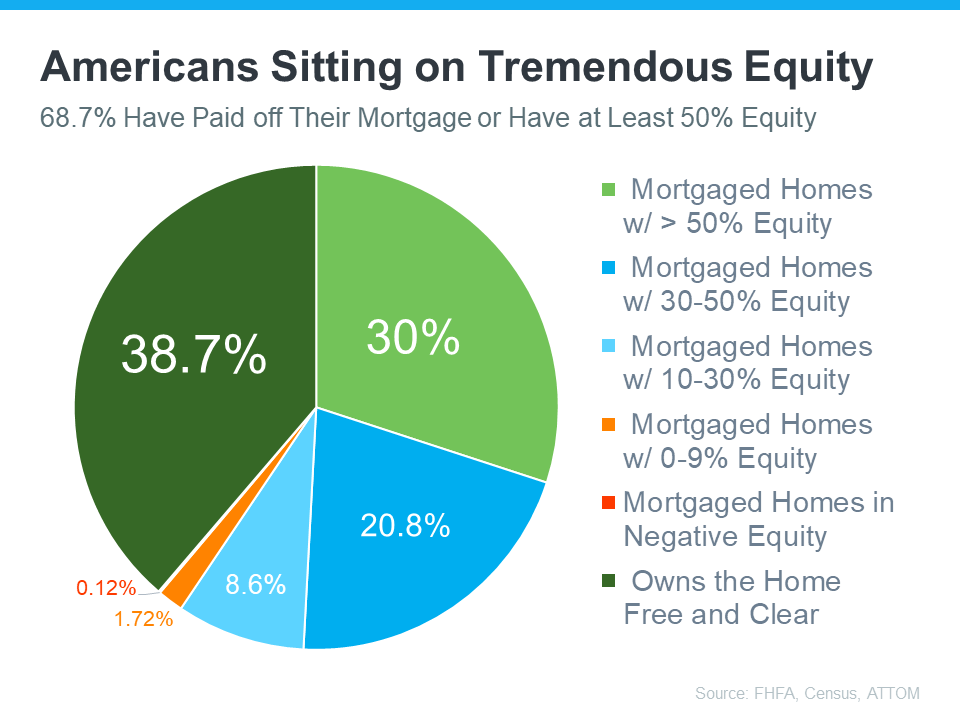

According to the Federal Housing Finance Agency (FHFA), the Census, and ATTOM, a property data provider, nearly two-thirds (68.7%) of homeowners have either fully paid off their mortgages or have at least 50% equity (see chart below):

That means nearly 70% of homeowners have a tremendous amount of equity right now.

How Equity Helps with Your Affordability Concerns

With today's affordability challenges, your equity can make a big difference when you decide to move. After you sell your house, you can use the equity you've built up in your home to help you buy your next one. Here's how:

- Be an all-cash buyer: If you've been living in your current home for a long time, you might have enough equity to buy a new house without having to take out a loan. If that's the case, you won't need to borrow any money or worry about mortgage rates. The National Association of Realtors (NAR) states:

"These all-cash home buyers are happily avoiding the higher mortgage interest rates . . ."

- Make a larger down payment: Your equity could be used toward your next down payment. It might even be enough to let you put a larger amount down, so you won't have to borrow as much money so today's rates become less of a sticking point. Experian explains:

"Increasing your down payment lowers your principal loan amount and, consequently, your loan-to-value ratio, which could lead to a lower interest rate offer from your lender."

Bottom Line

If you're thinking about moving, the equity you've built up can make a big difference, especially today. To find out how much equity you've got in your current house and how you can use it for your next home, get in touch with a trusted real agent.

For Sellers Interest Rates Housing Market Updates Selling Myths Tue, 19 Sep 2023 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2023/09/18/are-more-homes-coming-onto-the-market?a=269903-a3bc7e0ef3552315f90c02ba2f4aea1e

An important factor shaping today's market is the number of homes for sale.

An important factor shaping today's market is the number of homes for sale. And, if you're considering whether or not to list your house, that's one of the biggest advantages you have right now. When housing inventory is this low, your house will stand out, especially if it's priced right.

But there are some early signs that more listings are coming. According to the latest data, new listings (homeowners who just put their house up for sale) are trending up. Here's a look at why this is noteworthy and what it may mean for you.

More Homes Are Coming onto the Market than Usual

It's well known that the busiest time in the housing market each year is the spring buying season. That's why there's a predictable increase in the volume of newly listed homes throughout the first half of the year. Sellers are anticipating this and ramping up for the months when buyers are most active. But, as the school year kicks off and as the holidays approach, the market cools. It's what's expected.

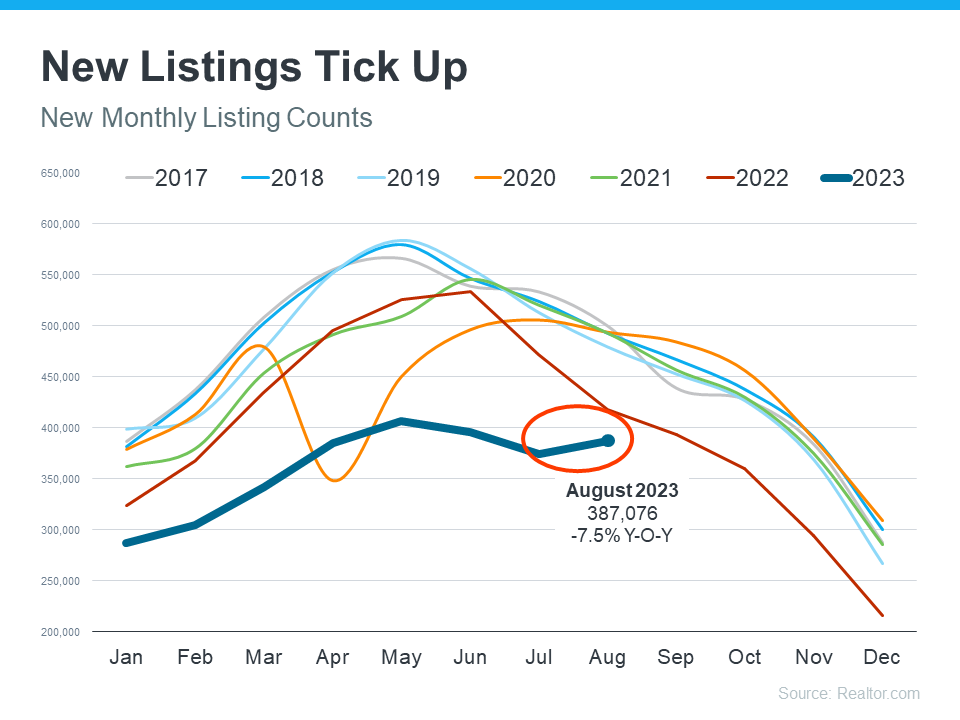

But here's wha's surprising. Based on the latest data from Realtor.com, there's an increase in the number of sellers listing their houses later this year than usual. A peak this late in the year isn't typical. You can see both the normal seasonal trend and the unusual August in the graph below: As Realtor.com explains:

As Realtor.com explains:

"While inventory continues to be in short supply, August witnessed an unusual uptick in newly listed homes compared to July, hopefully signaling a return in seller activity heading toward the fall season . . ."

While this is only one month of data, it's unusual enough to note. It's still too early to say for sure if this trend will continue, but it's something you'll want to stay ahead of if it does.

What This Means for You

If you've been putting off selling your house, now may be the sweet spot to make your move. That's because, if this trend continues, you'll have more competition the longer you wait. And if your neighbor puts their house up for sale too, it means you may have to share buyers attention with that other homeowner. If you sell now, you can beat your neighbors to the punch.

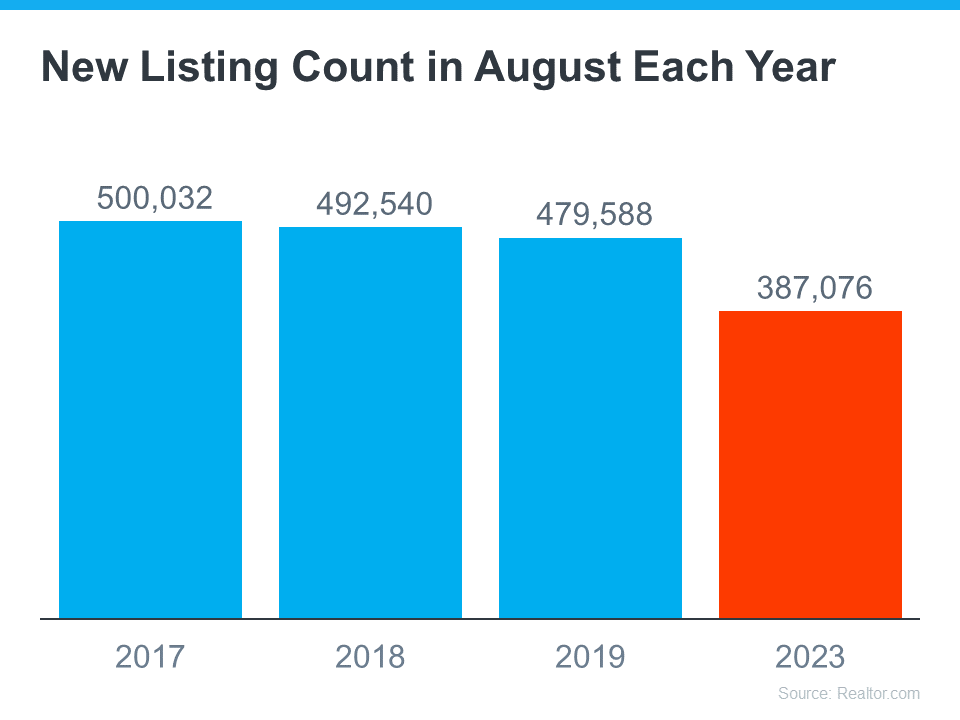

But, even with more homes coming onto the market, the market is still well below normal supply levels. And, that inventory deficit isn't going to be reversed overnight. The graph below helps put this into context, so you can see the opportunity you still have now:

Bottom Line

Even though inventory is still low, you don't want to wait for more competition to pop up in your neighborhood. You still have an incredible opportunity if you sell your house today. Connect with a real estate agent to explore the benefits of selling now before more homes come to the market.

For Sellers Housing Market Updates Selling Myths Mon, 18 Sep 2023 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2023/09/15/plenty-of-buyers-are-still-active-today-infographic?a=269903-a3bc7e0ef3552315f90c02ba2f4aea1e

Holding off on selling your house because you believe there aren't any buyers out there?

Some Highlights

- Holding off on selling your house because you believe there aren't any buyers out there?

- Data shows buyers are still active, even with higher mortgage rates. This goes to show, people still want to buy homes, and those who can are moving now.

- Don't delay your plan to sell for fear no one is buying. The opposite is true and buyer traffic is still strong today. Connect with a real estate agent to get your house in front of these buyers.

For Sellers Infographics Housing Market Updates Selling Myths Fri, 15 Sep 2023 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2023/09/14/why-is-housing-inventory-so-low?a=269903-a3bc7e0ef3552315f90c02ba2f4aea1e

One question that's top of mind if you're thinking about making a move today is: Why is it so hard to find a house to buy?

One question that's top of mind if you're thinking about making a move today is: Why is it so hard to find a house to buy? And while it may be tempting to wait it out until you have more options, that's probably not the best strategy. Here's why.

There aren't enough homes available for sale, but that shortage isn't just a today problem. It's been a challenge for years. Let's take a look at some of the long-term and short-term factors that have contributed to this limited supply.

Underbuilding Is a Long-Standing Problem

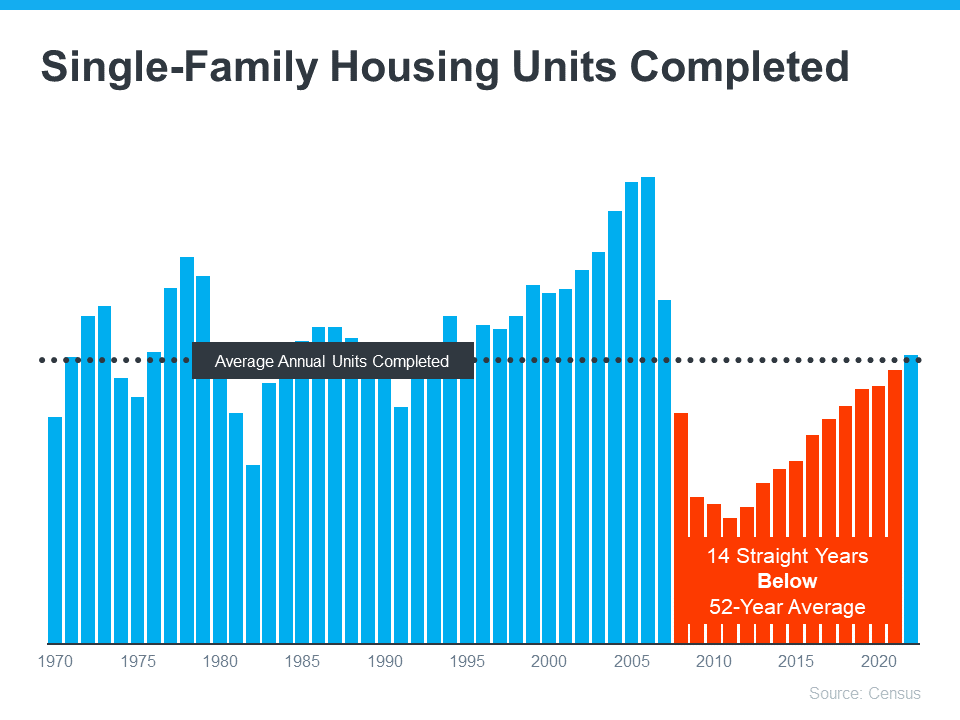

One of the big reasons inventory is low is because builders haven't been building enough homes in recent years. The graph below shows new construction for single-family homes over the past five decades, including the long-term average for housing units completed:

For 14 straight years, builders didn't construct enough homes to meet the historical average (shown in red). That underbuilding created a significant inventory deficit. And while new home construction is back on track and meeting the historical average right now, the long-term inventory problem isn't going to be solved overnight.

Today's Mortgage Rates Create a Lock-In Effect

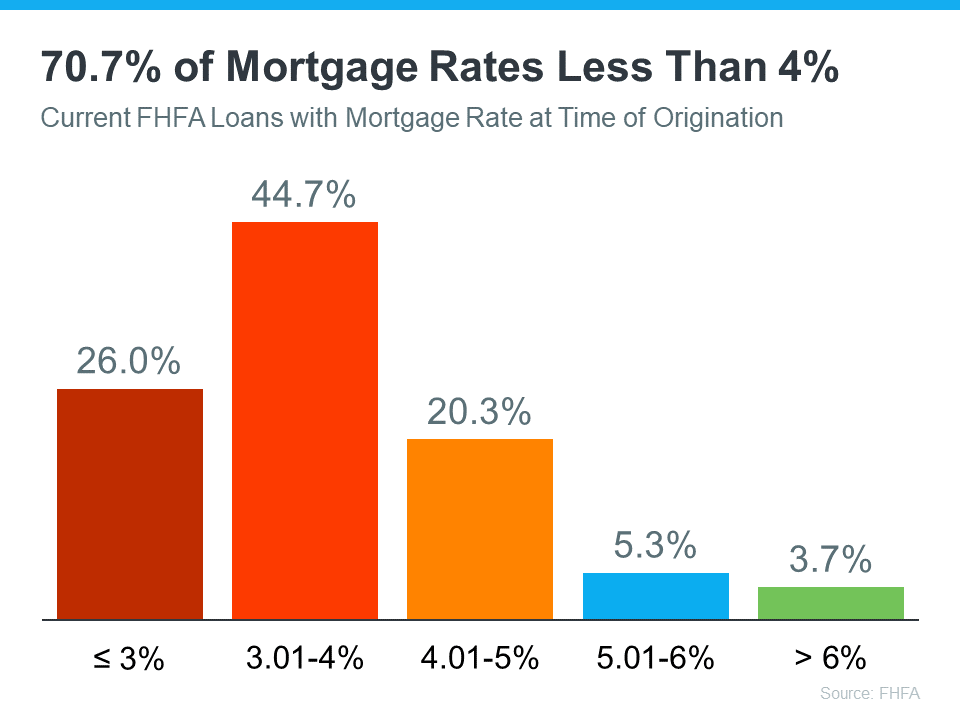

There are also a few factors at play in today's market adding to the inventory challenge. The first is the mortgage rate lock-in effect. Basically, some homeowners are reluctant to sell because of where mortgage rates are right now. They don't want to move and take on a rate that's higher than the one they have on their current home. The chart below helps illustrate just how many homeowners may find themselves in this situation:

Those homeowners need to remember their needs may matter just as much as the financial aspects of their move.

Misinformation in the Media Is Creating Unnecessary Fear

Another thing that's limiting inventory right now is the fear that's been created by the media. You've likely seen the negative headlines calling for a housing crash, or the ones saying home prices would fall by 20%. While neither of those things happened, the stories may have dinged your confidence enough for you to think it's better to hold off and wait for things to calm down. As Jason Lewris, Co-Founder and Chief Data Officer at Parcl, says:

"In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt."

That's further limiting inventory because people who would make a move otherwise now feel hesitant to do so. But the market isn't doom and gloom, even if the headlines are. An agent can help you separate fact from fiction.

How This Impacts You

If you're wondering how today's low inventory affects you, it depends on if you're selling or buying a home, or both.

- For buyers: A limited number of homes for sale means you'll want to seriously consider all of your options, including various areas and housing types. A skilled professional will help you explore all of what's available and find the home that best fits your needs. They can even coach you through casting a broader net if you need to expand your search.

- For sellers: Today's low inventory actually offers incredible benefits because your house will stand out. A real estate agent can walk you through why it's especially worthwhile to sell with these conditions. And since many sellers are also buyers, that agent is also an essential resource to help you stay up to date on the latest homes available for sale in your area so you can find your next dream home.

Bottom Line

The low supply of homes for sale isn't a new challenge. There are a number of long-term and short-term factors leading to the current inventory deficit. If you're looking to make a move, connect with a real estate agent. That way you'll have an expert on your side to explain how this impacts you and what's happening with housing inventory in your area.

For Buyers For Sellers Interest Rates Housing Market Updates New Construction Thu, 14 Sep 2023 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2023/09/13/should-baby-boomers-buy-or-rent-after-selling-their-houses?a=269903-a3bc7e0ef3552315f90c02ba2f4aea1e

Are you a baby boomer who's lived in your current house for a long time and you're ready for a change?

Are you a baby boomer who's lived in your current house for a long time and you're ready for a change? If you're thinking about selling your house, you have a lot to consider. Will you move to a different state or stay nearby? Is it time to downsize or do you want more space to accommodate your loved ones? But maybe the biggest consideration boils down to this – will you buy your next home or choose to rent instead?

That decision ultimately depends on your current situation and your future plans. Here are two important factors to help you decide what's right for you.

Expect Rents to Keep Going Up

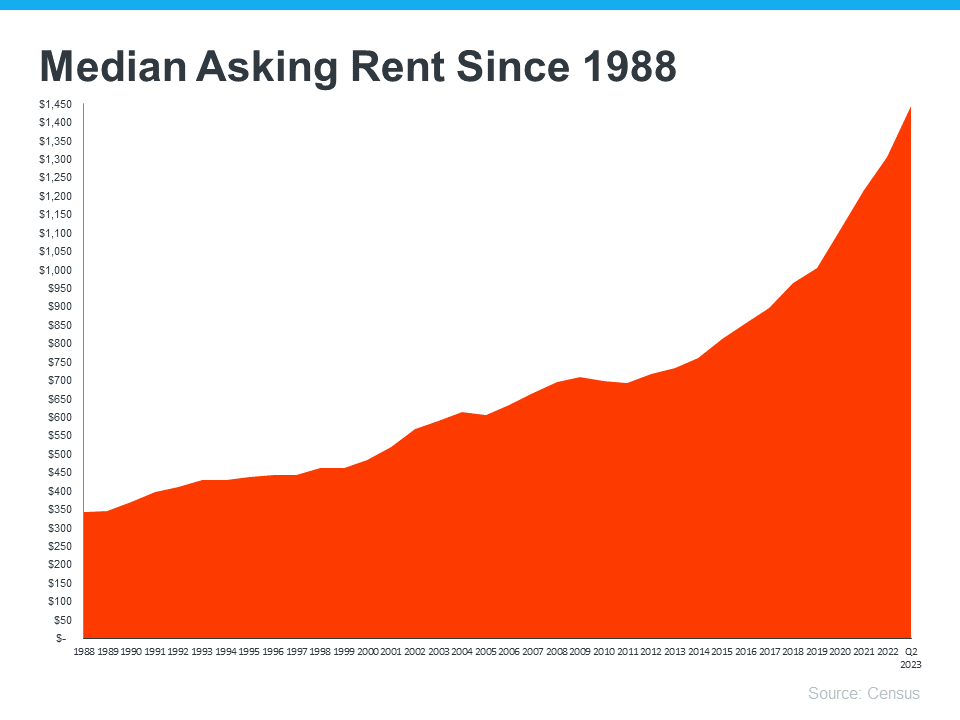

The graph below uses data from the Census to show how rents have been climbing steadily since 1988: Rents have been going up consistently over the long run. If you choose to rent, there's a risk your rental payment will go up each time you renew your lease. Having a higher rental expense may not be something you want to deal with every year.

Rents have been going up consistently over the long run. If you choose to rent, there's a risk your rental payment will go up each time you renew your lease. Having a higher rental expense may not be something you want to deal with every year.

When you buy a home with a fixed-rate mortgage, it helps stabilize your monthly housing payment. This allows you to lock in your monthly payment for the duration of your home loan. That keeps your payments steady and predictable for the long haul. Freddie Mac sums it up like this:

". . . homeowners with fixed-rate loans will see little to no change to their monthly housing cost over the life of their loan. You can be confident in knowing that your mortgage payments won't change much in the long term, even when life's other costs do."

Owning Your Home Comes with Unique Benefits

According to AARP, buying your next home is a better long-term strategy than renting:

"Though each option has pros and cons, buying provides more pros, with a broader range of benefits."

To help you choose what you’ll do after you sell, here are just a few of the benefits of homeownership that article covers:

- Owning your home can help you save money for the future. Your home, and the equity you build as a homeowner, can provide generational wealth that could be passed on to loved ones, giving them a better life.

- You might not have to pay a monthly mortgage payment at all. If you have enough equity to buy your next home outright, you wouldn't have a monthly mortgage payment. While you might still need to cover property taxes or maintenance fees, not having to worry about a monthly mortgage payment could be a big relief.

- Aging in place can be simpler. If your needs change, owning your home gives you the freedom to make renovations and updates that can make everyday life easier.

Bottom Line

If you're a baby boomer who's wondering whether you should buy or rent your next home, talk to a reliable real estate agent for advice. With rents going up and homeownership providing so many benefits, it may make sense to consider buying your next home.

For Buyers Demographics Baby Boomers Buying Myths Rent vs. Buy Wed, 13 Sep 2023 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2023/09/12/what-experts-project-for-home-prices-over-the-next-5-years?a=269903-a3bc7e0ef3552315f90c02ba2f4aea1e

If you're planning to buy a home, one thing to consider is what experts project home prices will do in the future and how that might affect your investment.

If you're planning to buy a home, one thing to consider is what experts project home prices will do in the future and how that might affect your investment. While you may have seen negative news over the past year about home prices, they're doing far better than expected and are rising across the country. And data shows, experts forecast home prices will keep appreciating.

Experts Project Ongoing Appreciation

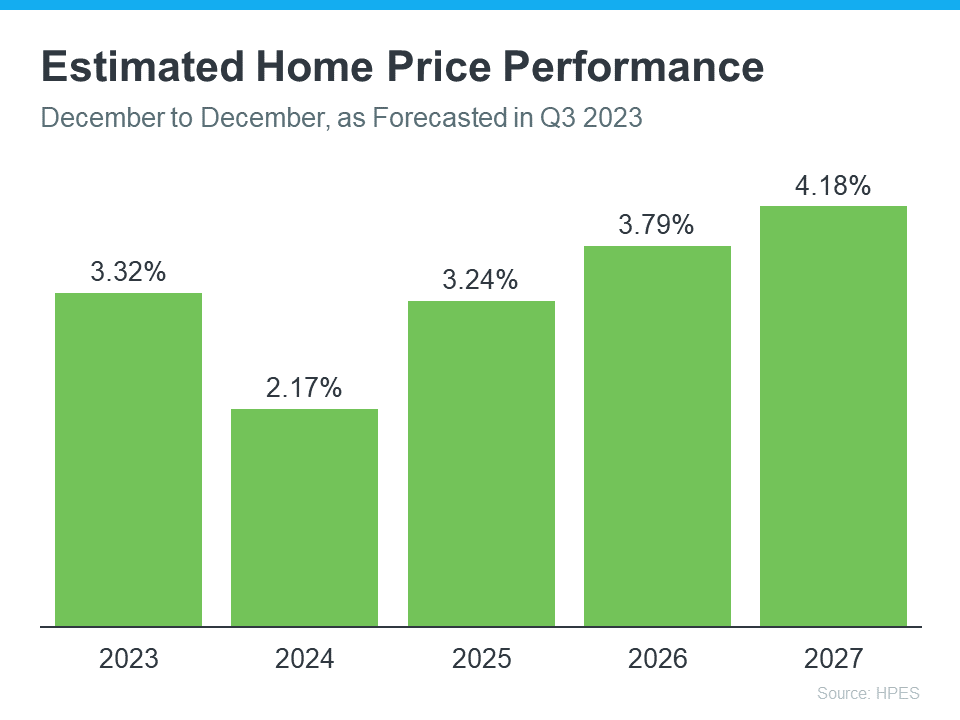

Pulsenomics polled over 100 economists, investment strategists, and housing market analysts in the latest quarterly Home Price Expectation Survey (HPES). The results show what the panelists project will happen with home prices over the next five years. Here are those expert forecasts saying home prices will go up every year through 2027 (see graph below): If you're someone who was worried home prices would fall because of stories you've read online, here's the big takeaway. Even though home prices vary by local market, experts project prices will continue to rise across the country for years to come. And these numbers indicate the return to more normal home price appreciation.

If you're someone who was worried home prices would fall because of stories you've read online, here's the big takeaway. Even though home prices vary by local market, experts project prices will continue to rise across the country for years to come. And these numbers indicate the return to more normal home price appreciation.

And while the projected increase in 2024 isn't as large as 2023, it's important to recognize home price appreciation is cumulative. In other words, if these experts are correct, after your home's value rises by 3.32% this year, it'll appreciate by another 2.17% next year. This is a good example of why owning a home is a choice that wins big over time.

What Does This Mean for You?

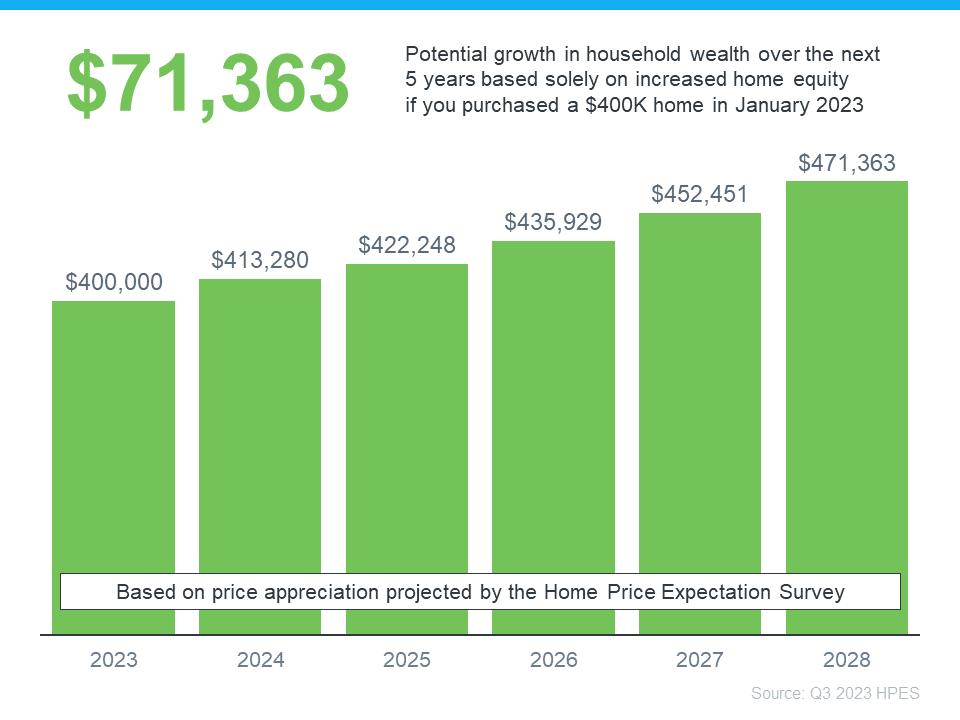

Once you buy a home, price appreciation raises your home's value, and that grows your household wealth. To see how a typical home's value could change in the next few years using the expert projections from the HPES, check out the graph below: In this example, let's say you bought a $400,000 home at the beginning of this year. If you factor in the forecast from the HPES, you could potentially accumulate more than $71,000 in household wealth over the next five years.

In this example, let's say you bought a $400,000 home at the beginning of this year. If you factor in the forecast from the HPES, you could potentially accumulate more than $71,000 in household wealth over the next five years.

So, if you're thinking about whether buying a home is a good choice, remember how it can be a powerful way to grow your wealth in the long run.

Bottom Line

According to the experts, home prices are expected to grow over the next five years at a more normal pace. If you're ready to become a homeowner, know that buying today can set you up for long-term success as home values (and your own net worth) grow. Connect with a local real estate agent to start the homebuying process today.

For Buyers First Time Home Buyers Move-Up Buyers Housing Market Updates Buying Myths Tue, 12 Sep 2023 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2023/09/11/planning-to-retire-your-equity-can-help-you-make-a-move?a=269903-a3bc7e0ef3552315f90c02ba2f4aea1e

Reaching retirement is a significant milestone in life, bringing with it a lot of change and new opportunities.

Reaching retirement is a significant milestone in life, bringing with it a lot of change and new opportunities. As the door to this exciting chapter opens, one thing you may be considering is selling your house and finding a home better suited for your evolving needs.

Fortunately, you may be in a better position to make a move than you realize. Here are a few reasons why.

Consider How Long You've Been in Your Home

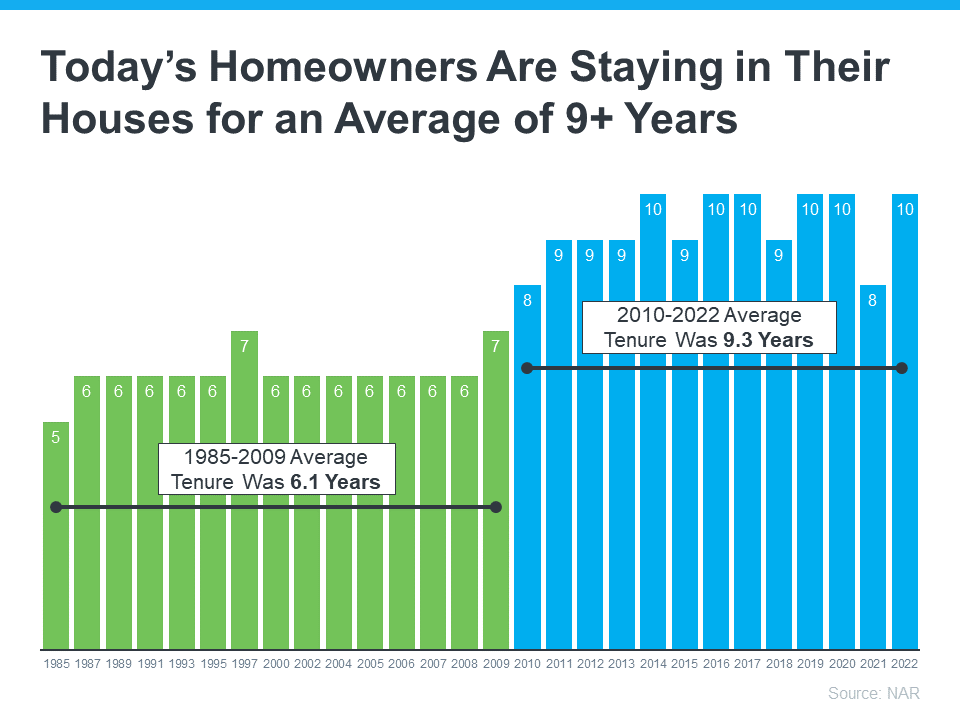

From 1985 to 2009, the average length of time homeowners stayed in their homes was roughly six years. But according to the National Association of Realtors (NAR), that number is higher today. Since 2010, the average home tenure is just over nine years (see graph below):

This means many homeowners have been living in their houses even longer in recent years. When you live in a home for such a significant amount of time, it's natural for you to experience changes in your life while you're in that house. As those life changes and milestones happen, your needs may change. And if your current home no longer meets them, you may have better options waiting for you.

This means many homeowners have been living in their houses even longer in recent years. When you live in a home for such a significant amount of time, it's natural for you to experience changes in your life while you're in that house. As those life changes and milestones happen, your needs may change. And if your current home no longer meets them, you may have better options waiting for you.

Consider the Equity You've Gained

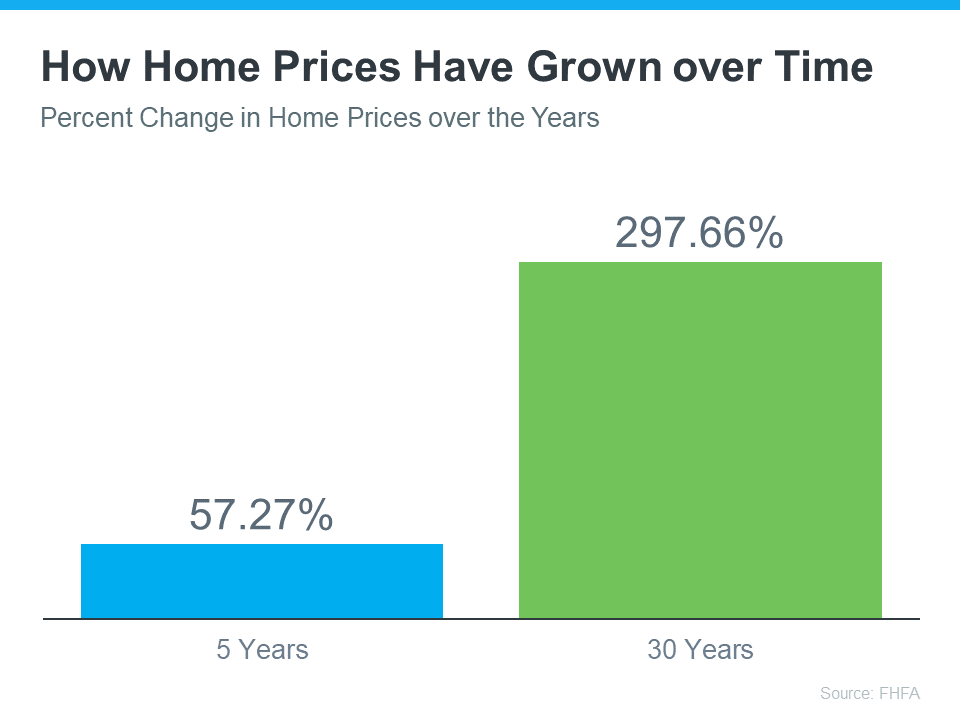

And, if you've been in your home for more than a few years, you've likely built-up substantial equity that can fuel your next move. That's because you gain equity as you pay down your loan and as home prices appreciate. And, the longer you've been in your home, the more you may have gained. Data from the Federal Housing Finance Agency (FHFA) illustrates that point (see graph below):

While home prices vary by area, the national average shows the typical homeowner who's been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who's owned their home for 30 years saw it almost triple in value over that time.

While home prices vary by area, the national average shows the typical homeowner who's been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who's owned their home for 30 years saw it almost triple in value over that time.

Whether you're looking to downsize, relocate to a dream destination, or move so you live closer to friends or loved ones, that equity can help. Whatever your home goals are, a trusted real estate agent can work with you to find the best option. They'll help you sell your current house and guide you as you buy the home that's right for you and your lifestyle today.

Bottom Line

As you plan for your retirement, connect with a local real estate agent to find out how much equity you've built up over the years and plan how you can use it toward the purchase of a home that fits your changing needs.

For Sellers Demographics Selling Myths Mon, 11 Sep 2023 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2023/09/08/home-price-forecasts-revised-for-2023-infographic?a=269903-a3bc7e0ef3552315f90c02ba2f4aea1e

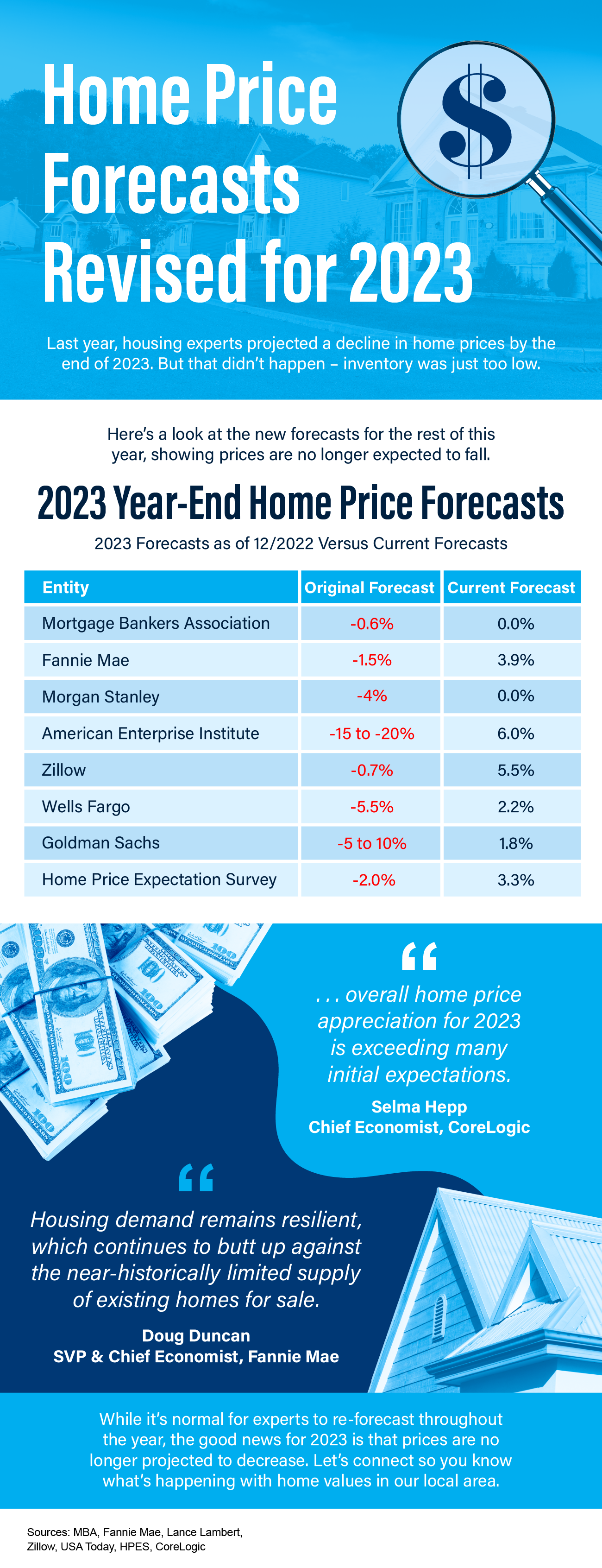

Last year, some housing experts projected a decline in home prices by the end of 2023. But that didn't happen & inventory was just too low.

Some Highlights

- Last year, some housing experts projected a decline in home prices by the end of 2023. But that didn't happen & inventory was just too low.

- While it's normal for experts to re-forecast throughout the year, the good news for 2023 is that prices are no longer projected to decrease.

- Connect with your trusted real estate agent to find out what's happening with home values in your local area.

Sources

- https://www.mba.org/docs/default-source/research-and-forecasts/forecasts/mortgage-finance-forecast-dec-2022.pdf

- https://www.mba.org/docs/default-source/research-and-forecasts/forecasts/2023/mortgage-finance-forecast-aug-2023.pdf

- https://www.fanniemae.com/media/45801/display

- https://www.fanniemae.com/media/48726/display

- https://twitter.com/NewsLambert/status/1671900591113609216 (Morgan Stanley)

- https://twitter.com/NewsLambert/status/1671556169712672768 (AEI)

- https://www.zillow.com/research/data/

- https://www.zillow.com/research/housing-market-challenges-32923/

- https://ustoday.news/a-20-drop-in-house-prices-7-forecast-models-tend-to-crash-here-the-other-13-models-show-the-housing-market-in-2023/ (Wells Fargo)

- https://twitter.com/NewsLambert/status/1686959362563092480 (Wells Fargo)

- https://twitter.com/NewsLambert/status/1691799764466008217 (Goldman Sachs)

- https://pulsenomics.com/surveys/#home-price-expectations

- https://www.corelogic.com/intelligence/us-corelogic-sp-case-shiller-index-down-by-0-5-year-over-year-in-may-but-a-turning-point-may-be-ahead/

- https://view.e.fanniemae.com/?qs=

Infographics Pricing Fri, 08 Sep 2023 10:30:00 +0000

https://www.simplifyingthemarket.com/en/2023/09/07/get-ready-for-smaller-more-affordable-homes?a=269903-a3bc7e0ef3552315f90c02ba2f4aea1e

Have you been trying to buy a home, but higher mortgage rates and home prices are limiting your options?

Have you been trying to buy a home, but higher mortgage rates and home prices are limiting your options? If so, here's some good news & based on what Ali Wolf, Chief Economist at Zonda, has to say & smaller, more affordable homes are on the way:

"Buyers should expect that over the next 12 to 24 months there will be a notable increase in the number of entry-level homes available."

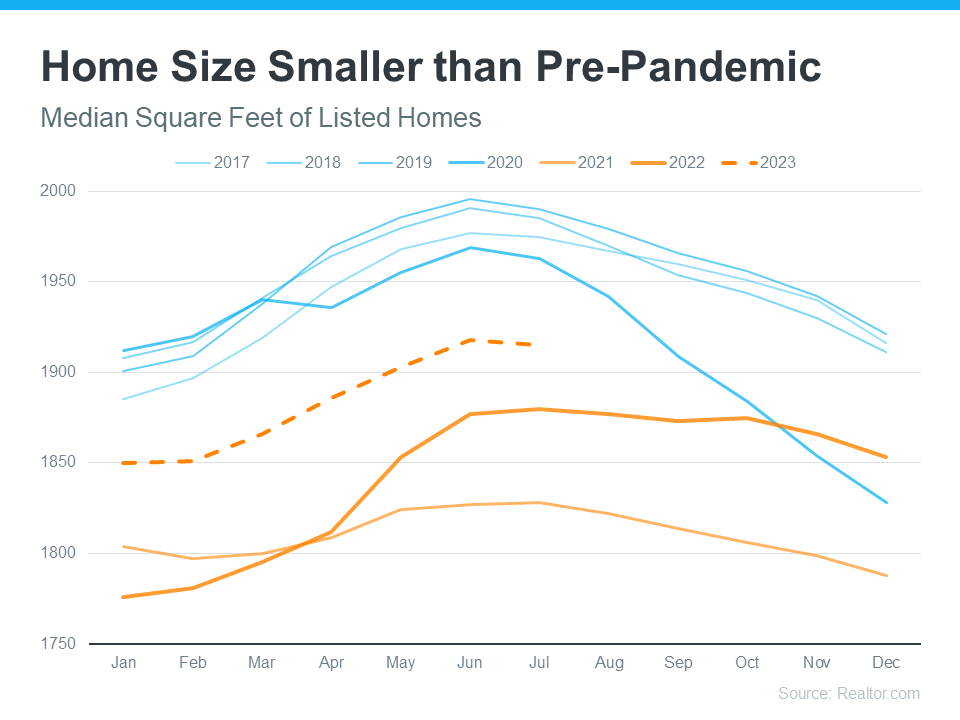

In some ways, smaller homes are already here. When the pandemic hit, the meaning of home changed. People needed the space their home provided not only as a place to live, but as a place to work, go to school, exercise, and more. Those who had that space were more likely to keep it. And those that didn't were in a position where they were trying to sell their smaller house to move up to a larger one. That meant the homes coming to the market during the pandemic were smaller than those on the market before the pandemic & and that trend continues today (see graph below): This graph also shows how the size of homes on the market changes seasonally. Larger homes tend to come on the market during the summer months when households with children who are out of school are looking to move.

This graph also shows how the size of homes on the market changes seasonally. Larger homes tend to come on the market during the summer months when households with children who are out of school are looking to move.

That seasonality means, based on historical trends and the fact that fall is now approaching, we can expect smaller, more affordable homes to come to the market throughout the rest of the year.

That's great news because, as Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), states, the need for these types of homes has gone up recently:

". . . as interest rates increased in 2022"

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "